Stability in Central London market – an indicator of UK property market’s health

The Central London rents remain stable… The prime yields remain stable… Supply continues to increase across Central London… Investment stocks remain in high demand.

These statements are not part of any wish-list of the stakeholders of the UK property market, but are highlights of the Central London Quarterly Report (Offices) – Q1, 2017, released by real estate advisor Knight Frank.

The data is a clear indication of the health of the UK property market, which remains buoyant despite multiple challenges in 2016. For, it is the Central London market, which is always the first victim of any upheavals in the UK real estate sector. But the current picture doesn’t call for any panic, as predicted by a few last year following UK’s exit from the European Union.

According to Knight Frank, the theme emerging from the first quarter of 2017 has been ‘business as usual’ across Central London. The occupier take-up is consistent with long-term average levels while supply is beginning to fall. The Central London market is in an advantageous position to deal with the challenges this year may present.

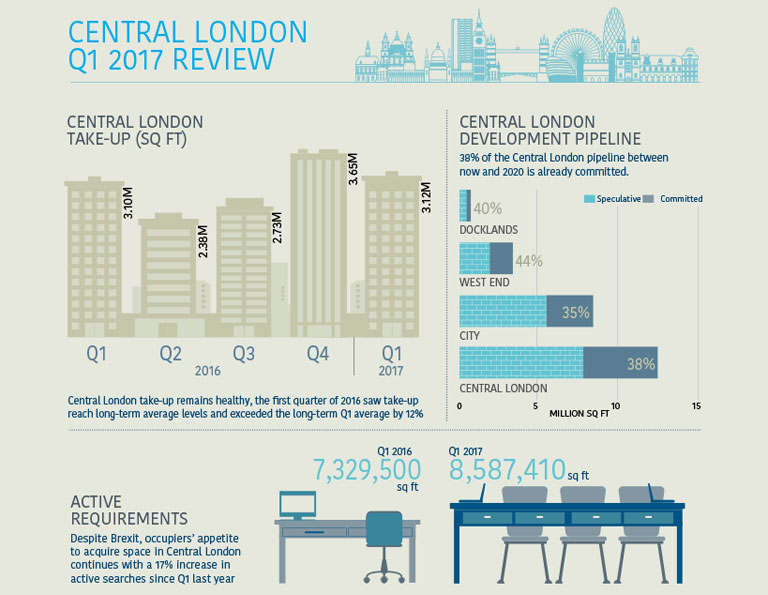

After the strong take-up recorded during the last quarter of 2016, it would have been reasonable to expect a weak first quarter for occupier demand in Central London in 2017. But take-up has come in exactly at the long-term average – 3.10 million sq ft. Besides, deals of over 100,000 sq ft. accounted for 17.5 per cent of take-up, which is line with activity in the last 10 years, Knight Frank observed.

The future holds good for the Central London property market as occupiers’ appetite to acquire space in the area continues with a 17 per cent increase in active searches since Q1 last year. The development pipeline is also strong with 38 per cent of the Central London pipeline between now and 2020 already committed.

It is also interesting to note how international investment is flowing into the Central London market. Overseas investors continue to target Central London assets because of the strong fundamentals of the property market.

Investors from the Far East region comprising Hong Kong, China, Singapore, Japan and South East nations accounted for 55 per cent of the investment turnover during Jan-March 2017.

Investors from the Middle East continued to show interest in Central London and they constituted 7 per cent of the investors during the first quarter of this year. UK investors accounted for 20 per cent while mainland European investors were responsible for 15 per cent of the transactions during Jan-March 2017. Central London will continue to attract investors from all over the world, as witnessed in the last three months, as the returns have been consistent from the long-term perspective.