London house rents account for significant proportion of disposable income

Tenants of one-bedroom apartments in London, one of the top real estate markets in the world, are spending a significant proportion of their disposable income, in paying their monthly rents, the latest Landbay Rental Index has revealed.

This finding indicates the housing crisis in London where home prices are one of the highest in the world. As the cost of housing increases, more number of people is turning towards rented accommodation. However, the fact that they are spending a major portion of their disposable income on paying rents rather than acquiring owner-occupied homes highlights the widening gap between demand and supply of quality homes.

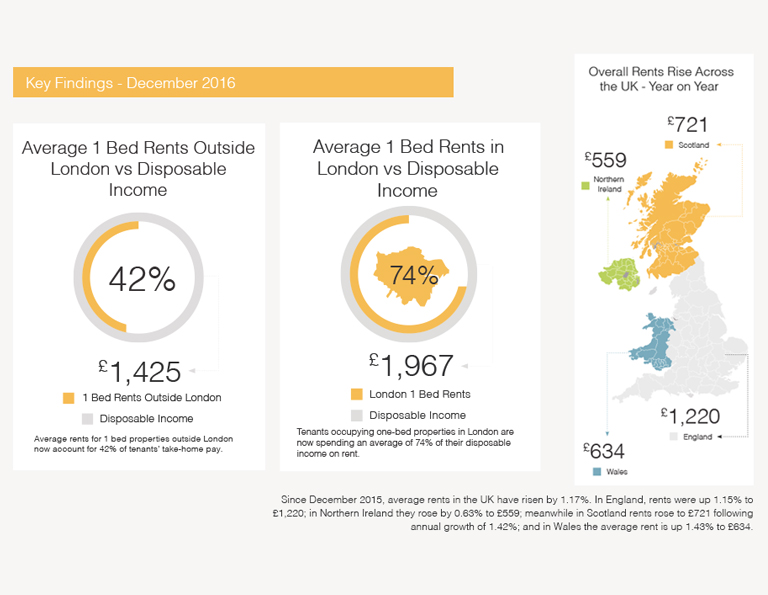

The average one bedroom rent in London has reached £1,967, which is equivalent to 74 percent of the disposable income of the tenants. The wage growth, however, has not kept pace correspondingly, thereby putting pressure on tenants. In fact, the disposable income (net salary) fell by 2.3 percent during the first nine months of 2016, the Landbay Rental Index observed.

The average rents (£1,967) in London are more than double the average rent for the rest of the country. The Index noted that tenants in London must rely on multiple incomes or high-income earners to make rental payments.

Outside London too, the rent for one-bedroom apartments is at a high of £1,425, accounting for about 42 percent of the disposable income of the tenants.

The average rents paid for a residential property in the UK outside London reached £750 by 2016 end while disposable incomes dropped by 2 per cent (£1,425).

If the tenants of one-bedroom apartments are under enormous pressure, the situation is no different for tenants of three-bedroom apartments in London. The average rent for a three-bedroom apartment is £2,690, which is three times that of the national average. This also indicates the demand for three-bedroom apartments in London, as families tend to prefer bigger space. At the same time, it also points towards the shortage of three-bedroom apartments in the capital city.

The availability of two-bedroom apartments in London is higher than that of 1-bedroom and 3-bedroom apartments. Consequently, the average rent for a 2-bedroom apartment in London is £650, but it varies depending on the size of the house. The majority of the tenants, however, are in the 1-bedroom and 3-bedroom categories.

The situation also provides an opportunity for investors to acquire 1-bedroom or 3-bedroom residential apartments in London for an assured rental income in the long-term. The capital value of such assets also rises correspondingly. The rents and capital values of residential buildings are poised for growth in London given the growing gap between demand and supply of quality homes.

If you are keen on acquiring a buy-to-let home for rental income in London, Strawberry Star has several options for you with an assured ROI. Contact our London office to fix an appointment with her estate agents.

Source: rentcheck.landbay.co.uk

Image: Landbay